Business Insurance in and around Templeton

One of the top small business insurance companies in Templeton, and beyond.

No funny business here

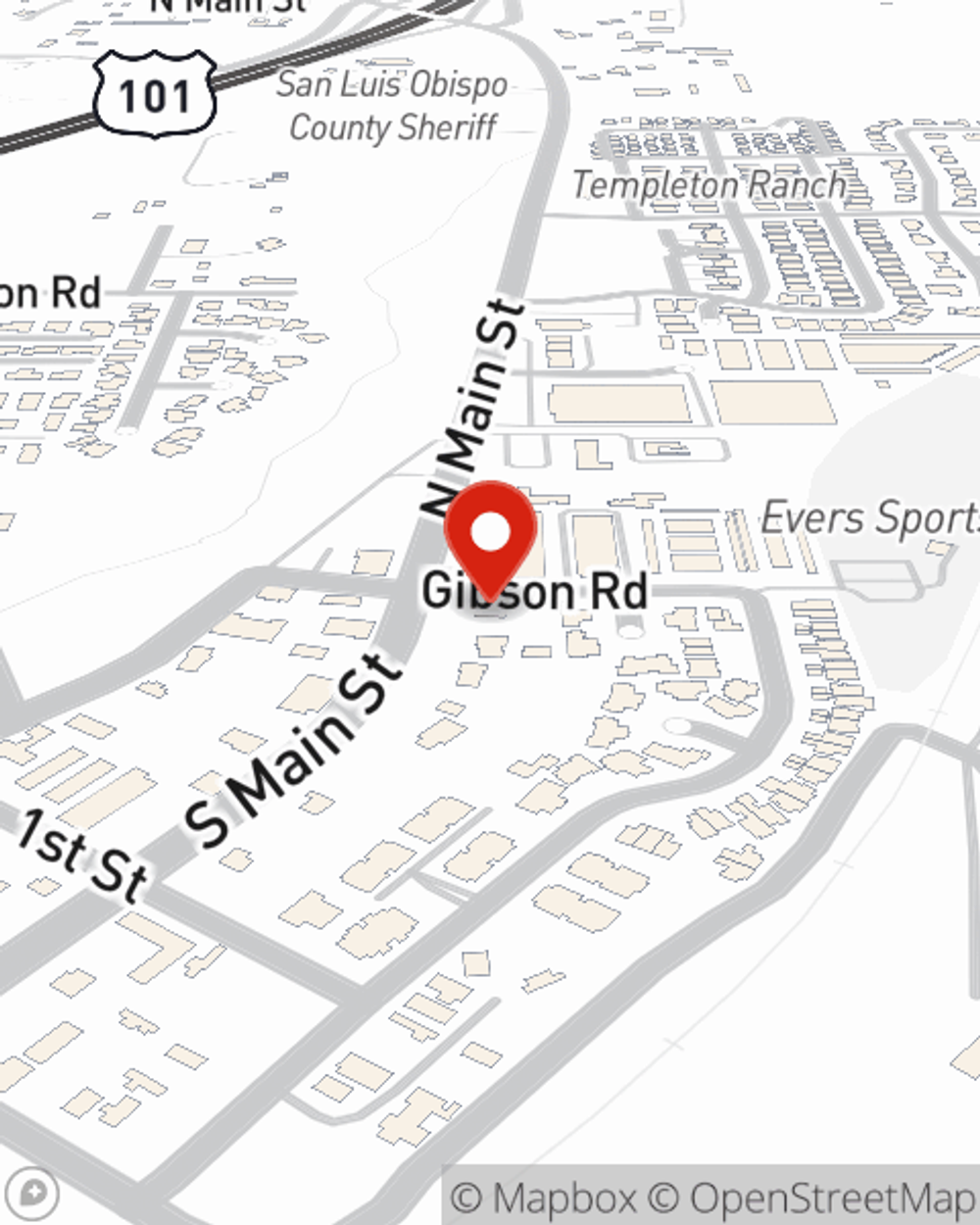

- 93465

- 93451

- 93461

- 93446

- 93428

- 93435

- 93426

- 93932

- 93452

- 93450

- 93928

- 93920

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide excellent insurance for your business. Your policy can include options such as a surety or fidelity bond, errors and omissions liability, and worker's compensation for your employees.

One of the top small business insurance companies in Templeton, and beyond.

No funny business here

Surprisingly Great Insurance

Whether you own a cosmetic store, a toy store or a farm supply store, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by contacting agent Courtney Morrow's team to review your options.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Courtney Morrow

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.